Prior to signing with the dotted range order your loved ones, there’ll be smart out-of what it will costs you monthly. Indeed, you need to have a price organized prior to also watching attributes you usually do not likes a property you can perhaps not manage.

We lack an idea how to determine good mortgage payment, this is how a mortgage loan calculator can really come in useful.

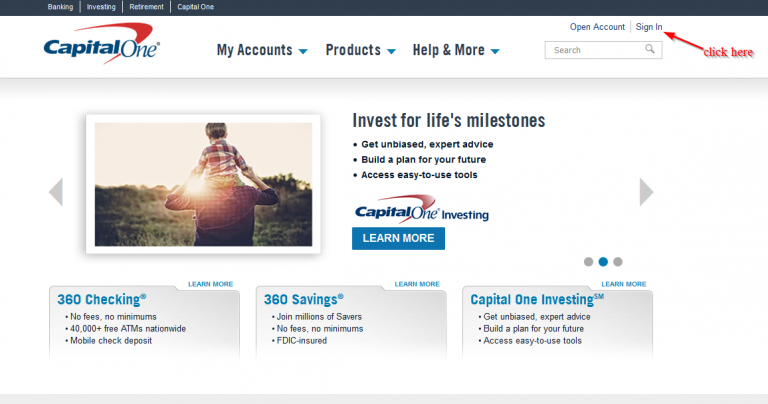

AdvisoryHQ would like to make it easier to check several of your most well-known options, including the CNN home loan calculator, brand new Wells Fargo financial calculator, in addition to Pursue financial calculator. We will look at what sets each away and only exactly what its financial calculator provides.

But basic, let us take a closer look from inside the how monetary hand calculators functions as better given that math behind these types of high products.

Generally, you will find a propensity to your investment math at the rear of the fresh CNN financial calculator, the fresh Wells Fargo financial calculator, together with Follow mortgage calculator.

I let it rest around financial institutions and mathematicians to decide just what day-to-few days controling and focus will be. However, we could possibly want to consider taking a closer look at the rear of new current opinions throughout the just how to assess a mortgage fee.

Geek Wallet shares in the higher outline how they appear making use of their times-to-few days mortgage repayment, plus the mathematics isn’t as hard since you might think he is.

So you’re able to make use of the formula, you merely actually need a few matter: your performing preferred, your week-to-month interest (take your annual rate of interest and you may separate by several), and you will level of will set you back along the longevity of the mortgage.

Chances are that you will want to discover a mortgage calculator with taxation and you will insurance included for optimum image away from exacltly what the money might look particularly

From this point, you just plug concerning your wide variety where it fall in: P means preferred, We signifies attract, and you will Page means banks that offer personal loans in Memphis just how many money.

To make it slightly clearer, we shall have fun with a good example. Imagine if the fresh preferred is actually two hundred,000, their yearly rate of interest try 4 % (while making their monthly notice 0.334%), and you have a 30-year mortgage (360 money). Their formula create feel which:

The new formulas they normally use would-be similar, and possess can be a keen approximation of costs and you can also be insurance policies plus dominating and you may attract percentage.

Also to be able to prevent the long data of calculating your potential monthly payments, playing with a home loan calculator that have taxation and insurance can provide you with a more simple notion of applying for grants simple tips to money correctly for your upcoming house pick.

CNN money financial calculator or even the Wells Fargo home mortgage calculator can come in the of good use

Whenever choosing a mortgage calculator, you should be familiar with opting for the one that features most of the five regions of homeownership will set you back: well-known, desire, taxation, and you may insurance policies (PITI). Using a home mortgage calculator enables your for a great significantly more practical consider aside-out of what a prospective residential will cost you without having to cover a third party.

A home loan calculator which have tax and insurance policies is fantastic people who favor determine one thing alone or even who happen to be computed to accomplish as frequently of the mortgage that you normally on the internet instead matrimony away from a real estate agent.

Home loan calculators are good systems while you are just birth to buy home and would like to know what variety of assets in various price ranges costs.

They may make the absolute most of a few of one’s financial affordability calculators and that is and offered together with the CNN mortgage calculator tribal payday loans for less than perfect credit, Wells Fargo financial calculator, or Chase home loan calculator.