What is the difference between a home Equity Mortgage and you may Collection of Credit (HELOC)?

All of it boils down to the you desire! If you have a-one-big date expenses such as for instance brief-name do-it-yourself and are usually interested in a fixed rate that have a foreseeable monthly payment, a property Equity Loan might be best. For people who welcome looking for independence for money through the years getting anything eg lingering renovations or debt consolidation, a good HELOC could be ideal cure. A house Fund Expert might possibly be prepared to discuss your needs and section your regarding the correct direction.

Exactly what establishes the interest rate to my mortgage?

Your credit rating is amongst the situations always determine the speed in your financing. Sign up for the Totally free Credit history to have constant revealing and you can overseeing. We’re going to and additionally opinion simply how much of your monthly earnings would go to paying financial obligation (debt-to-earnings proportion).

Exactly how much do i need to use?

The value of your property was a key cause for focusing on how much you https://availableloan.net/installment-loans-tx/houston/ might be qualified to receive, with the flexibility to go up to 100% loan-to-worth (LTV).

How do i prepare before you apply?

Most items is asked, however, a good place to begin is to accumulate W-2s in addition to current shell out stubs getting proof of money, family savings and you can financial comments, in addition to private identification.

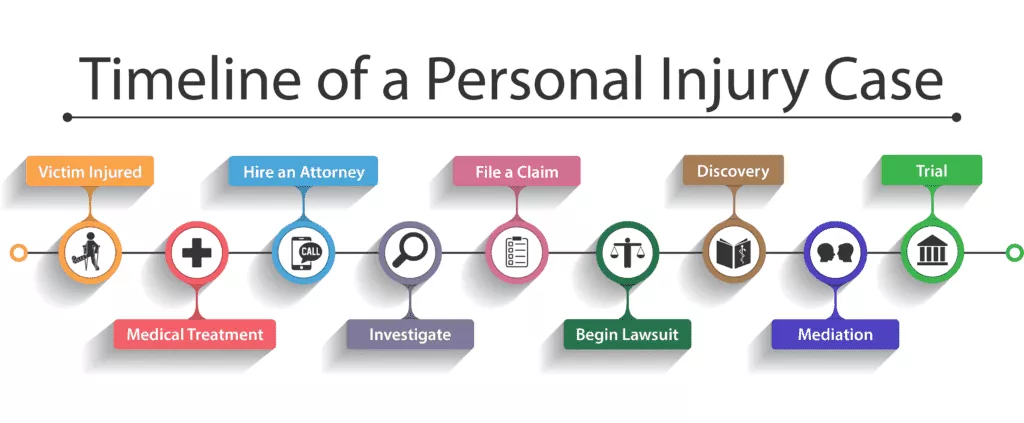

I am happy to proceed. Just what are my personal second tips?

Once you have selected a house Equity Financing otherwise Distinct Borrowing from the bank, feel free to incorporate . On achievement, you get interaction regarding the mortgage choice. Property Financing Specialist will contact you to definitely address any questions you really have regarding procedure. Upcoming, you’ll indication certain closing data files and have accessibility your finance!

HELOC 0.99% APR: Annual percentage rate is actually Annual percentage rate. Eligible user gets an introductory . Toward , the brand new Apr towards remaining advertisements balances increases into the simple Annual percentage rate. All the subsequent enhances will get the quality Annual percentage rate. To be eligible for the brand new advertising Annual percentage rate: 1) User must open another home equity credit line; 2) Representative should have a great BCU bank account in the course of funding; 3) The latest money in order to BCU only, and you can affiliate cannot possess an existing or earlier in the day BCU domestic equity mortgage or credit line open during the last 1 year. Basic Apr cannot be put on a current BCU household security mortgage or line of credit. Basic Annual percentage rate relates to combined mortgage-to-worthy of (CLTV) as much as 80%. Limited time render at the mercy of prevent without notice.

step one Settlement costs are very different from the condition and you can are normally taken for $700-$1300. Debtor tends to be responsible for closing costs, such as assessment, flooding devotion, label insurance and recording costs. Will set you back to fulfill particular early in the day liens can be analyzed.

dos You can reduce your Apr doing 0.50% having Benefits Cost. Including a beneficial 0.50% discount in order to have a couple of following the relationship: lead put of at least $step 1,000 four weeks to your credit connection family savings; no less than $25,000 for the put, or a loan for the an effective reputation. Qualifying financing types are home loan, family security, automobile, and you can bank card. A being qualified financing need a recent balance and handmade cards must have an exchange in the last 30 days. One Borrowing from the bank Partnership financing that’s not for the good standing or unpaid usually disqualify your to possess Benefits Costs. All the costs is subject to borrowing from the bank qualification and recognition. The fresh costs shown would be the lower offered plus price get end up being higher.

3 Annual percentage rate was Annual percentage rate. The fresh Apr was a variable speed in accordance with the higher Finest Speed penned regarding the Money Costs part of the Wall surface Highway Journal into the basic business day of the 30 days. The newest Annual percentage rate on the BCU’s security range affairs vary anywhere between dos.99% and you can %, based on your acknowledged connection amount, device and borrowing certificates. Costs revealed assume an automatic percentage strategy. It’s also possible to reduce your Annual percentage rate as much as 0.50% with Perks Rates. This can include a 0.50% discount in order to have a couple of following dating: direct deposit with a minimum of $step 1,000 a month into the borrowing union checking account; at the very least $twenty five,000 with the put, or a loan during the a position. Being qualified financing designs include mortgage, domestic equity, car, and you may charge card. Closing costs vary from the state and you will cover anything from $700-$1300. Borrower can be responsible for settlement costs, such as for instance appraisal, ton dedication, term insurance policies and you can recording charges. Costs in order to satisfy certain earlier liens could be examined. Possessions insurance policy is called for; flood insurance rates may be needed. Give relates to manager-occupied residential step one-4 members of the family services which will be subject to about a beneficial 2nd lien position on your property which can be at the mercy of the underwriting conditions. Consult your taxation advisor regarding your deductibility of great interest. All finance at the mercy of latest borrowing from the bank approval, which includes confirmation away from application suggestions and you will bill away from security files.

4 A home Equity Mortgage or Credit line have to be moved to the credit Relationship out-of a special financial institution to meet the requirements. Money back count differ because of the state. GA, WI, AZ, Florida, MD, and you may Nyc professionals will get $200 cash return. Various other claims will get $250 cash return. Cash return count could well be transferred into the Borrowing Connection discounts otherwise bank account in the event that mortgage closes. We’re going to not deposit the cash straight back number on the an account at the another financial institution. Relates to financing around 80% LTV (loan-to-value). Must take the very least initial advance out of $20,000 within the the money in buy become qualified to receive the newest money back promote. Current Credit Commitment Family Collateral Fund/Personal lines of credit and Borrowing from the bank Partnership Basic Mortgage loans do not meet the requirements for it promote.