A construction company that used cost reporting to monitor and control the progress and budget of a large-scale project. This means presenting the cost data and metrics in a clear, concise, and consistent manner, using tables, charts, graphs, and narratives. The cost report should follow the standards and guidelines of the organization and the industry, as well as the expectations and preferences of the audience.

8.6 Preparing a Production Cost Report – Weighted Average

Process Costing always follows the same process while job-order costing applies to each job separately. Describe the three groups of units that must be accounted for when using the FIFO method. The MST Manufacturing Company produces one product that passes through a single process in a manufacturing cycle lasting approximately 18 days. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. A financial analyst might use COGM as a key indicator of a company’s efficiency.

Calculating Direct Materials and Labor Costs

From the perspective of a cost accountant, the precision in these calculations ensures the integrity of financial reporting. Meanwhile, production managers view these costs as a measure of operational efficiency, and strategic planners use them to forecast and budget for future production cycles. Understanding the key components of a Cost of Production Report is crucial for any manufacturing business aiming to streamline its operations and maximize profitability. This report serves as a financial mirror, reflecting the detailed expenses incurred in the production process. By dissecting this report, stakeholders can pinpoint areas of cost savings, evaluate the performance of production methods, and make informed decisions about pricing strategies. It’s a tool that offers insights from the shop floor to the executive suite, providing a comprehensive view of the production’s financial health.

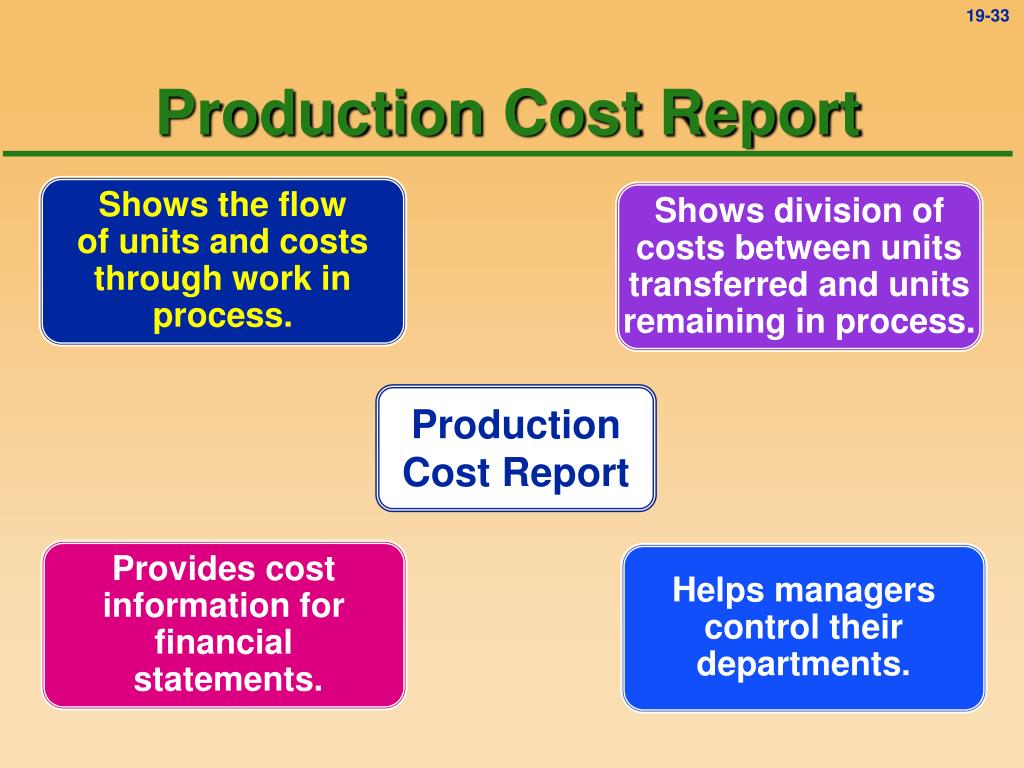

Production Cost Report Explained

Each component plays a vital role in painting a full picture of the production costs. By analyzing these elements, businesses can identify inefficiencies, adjust pricing, and improve their bottom line. For example, if the variance analysis consistently shows higher material costs than expected, the company might negotiate better rates with suppliers or seek alternative materials. Similarly, a high WIP might indicate bottlenecks in the production process that need to be addressed. The Jessica Company produces a product used to clean mirrors and head lights of vehicles.

- That’s not only less than half of its retail price in India, it is also 11 per cent lower manufacturing costs as compared to that of the Pixel 8 Pro.

- This system records costs at the time they are incurred and it is easier to have control over the job.

- Describe the three groups of units that must be accounted for when using the FIFO method.

- For example, a cost report for a large and complex project may require more distribution and communication than a cost report for a small and simple project.

- Secure means that the cost data is protected from unauthorized access, modification, or deletion.

What are the main differences between Process Costing and job-order costing?

It acts as a bridge between raw materials and finished goods, providing insights into the production flow and potential bottlenecks. By analyzing WIP Inventory, manufacturers can gain a clearer how to calculate predetermined overhead rate: formula and uses picture of their cost of production, identify areas for improvement, and better manage their resources. A Total costs to be accounted for (step 2) must equal total costs accounted for (step 4).

Organization

Verifiable sources are those that provide evidence and documentation that can be checked and confirmed. Some examples of reliable and verifiable sources are accounting records, invoices, receipts, timesheets, contracts, and budgets. It is important to collect the cost data from these sources as soon as possible after the costs are incurred, to avoid errors, omissions, or discrepancies. It is also important to keep track of the source of each cost data item, to facilitate the verification and validation process later. For example, consider a car manufacturer that starts with 100 units of raw steel (valued at $50 each) and incurs labor costs of $20 per unit. If 50 units are halfway through the assembly process, the WIP Inventory would include the cost of steel ($50 x 50 units) and half the labor costs ($10 x 50 units), totaling $3,000.

WIP Inventory is not just a financial figure; it’s a snapshot of the production process at a given moment. It provides valuable insights from both financial and operational perspectives, helping businesses to optimize their manufacturing processes and maintain a competitive edge. Understanding and managing WIP inventory is crucial for any manufacturing entity aiming to enhance its production efficiency and financial health. The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9. Notice that each section of thisreport corresponds with one of the four steps described earlier. Weprovide references to the following illustrations so you can reviewthe detail supporting calculations.

By comparing COGM with total sales, analysts can assess the gross margin and determine if a company is managing its production costs effectively. From a managerial perspective, analyzing COGM helps in making strategic decisions. Managers use COGM to set product pricing, budget for future periods, and make investment decisions. They also compare COGM with previous periods to track trends in production costs. Allocating manufacturing overhead is a multifaceted process that requires careful consideration of the company’s operations and the products it manufactures. It’s a balance between precision and practicality, ensuring that the cost of production report is a useful tool for decision-making.

The review and validation process may involve feedback, corrections, adjustments, and approvals. For example, a cost report for a grant-funded project may require more review and validation than a cost report for an internal project. This means identifying the purpose, audience, and format of the report, as well as the level of detail and frequency of reporting. For example, a cost report for a construction project may have a different scope and objective than a cost report for a marketing campaign. From an accountant’s perspective, COGS is a key figure for calculating gross profit, which is done by subtracting COGS from revenue. A production manager, however, might look at COGS to assess the efficiency of the production line.