Let’s assume that at the end of a period, we have 1000 units of raw materials left. Of those 1000 units, 600 were purchased at one price, and 400 were purchased earlier at a different price, as shown below. To calculate ending Inventory cost using the how to figure out which irs payment plan is best for you method can take a lot of work, and may require us to create a running tabular balance to keep track of how much we paid for each item. Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business building. In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead of focusing on the fear and anger, she started her accounting and consulting firm.

- Each time a product is sold, a revenueentry would be made to record the sales revenue and thecorresponding accounts receivable or cash from the sale.

- When a customer buys one of these products, the database lists one less product in its count.

- This is a more practical and efficient approach to the accounting for inventory which is why it is the most common approach adopted.

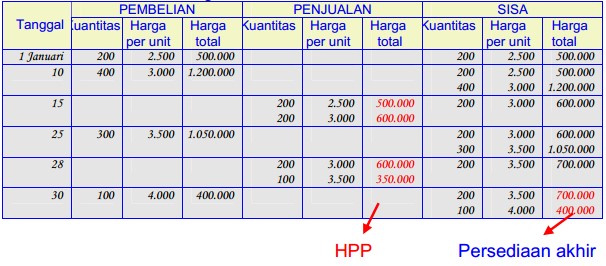

- The use of FIFO method is very common to compute cost of goods sold and the ending balance of inventory under both perpetual and periodic inventory systems.

Calculating Cost Using First-In, First-Out (FIFO Method)

The Internal Revenue Service allows companies to use LIFO in their tax accounting, even when they use FIFO in their financial statements. Huge businesses have difficulty performing the cycle counts that are necessary for a periodic system. Further, an organization with several retail locations may find it is easier to control inventory when there’s a regularly updated database of products. Take, for example, a tool retailer that has a customer looking for a specific type of wrench, one that is rarely requested and sold.

FIFO: Periodic Vs. Perpetual

Note that this $21 is different than the gross profit of $20 under periodic LIFO. Under first-in, first-out method, the ending balance of inventory represents the most recent costs incurred to purchase merchandise or materials. The following table, ledgers, and financial statements reveal the application of perpetual LIFO. The journal entries are not repeated here but would be the same as with FIFO; only the amounts would change. A perpetual inventory system tracks goods by updating the product database when a transaction, such as a sale or a receipt, happens. Every product is assigned a tracking code, such as a barcode or RFID code, that distinguishes it, tracks its quantity, location and any other relevant details.

Impacts of FIFO on Gross Profit

The first guitar was purchased in January for $40.The second guitar was bought in February for $50.The third guitar was acquired in March for $60. In the first example, we worked out the value of ending inventory using the FIFO perpetual system at $92. The ending inventory at the end of the fourth day is $92 based on the FIFO method. Finding the value of ending inventory using the FIFO method can be tricky unless you familiarize yourself with the right process.

First-In, First-Out Inventory (FIFO Inventory)

For example, Ava wants to figure out the average cost to assign for Acetone repackaged in her company’s warehouse. She will use this information to calculate the ending inventory and COGS for the period. See the ledger below for transactions for Acetone in Jan. using a weighted average. This ledger mimics that of a software ledger in a perpetual system. Theoretically, the cost of inventory sold could be determined in two ways. One is the standard way in which purchases during the period are adjusted for movements in inventory.

Perpetual vs. Periodic Inventory Systems

Then, the company can also compute the cost of goods available for sale for the new period. The cost of goods sold, inventory, andgross margin shown in Figure 10.19 were determined from the previously-stated data,particular to perpetual, AVG costing. FIFO (first-in, first-out) is a cost flow assumption that businesses use to value their stock where the first items placed in inventory are the first items sold. So the inventory left at the end of the period is the most recently purchased or produced. All periodic inventory systems calculate inventory at the end of the period. Therefore, we are not concerned about which units are on hand when a sale occurs.

Typical economic situations involve inflationary markets and rising prices. The oldest costs will theoretically be priced lower than the most recent inventory purchased at current inflated prices in this situation if FIFO assigns the oldest costs to the cost of goods sold. Therefore, we only need to look at the most recent purchases to determine how much our ending Inventory costs. When the cost of inventory is rising, FIFO will ensure that the older, less expensive inventory cost is transferred to Cost of Goods Sold. Inventory on the balance sheet will be higher than when using other inventory methods, assuming costs are rising.

The company sells an additional 50 items with this remaining inventory of 140 units. The cost of goods sold for 40 of the items is $10 and the entire first order of 100 units has been fully sold. The other 10 units that are sold have a cost of $15 each and the remaining 90 units in inventory are valued at $15 each or the most recent price paid. Remember that ending inventory is what is left at the end of the period. The units from beginning inventory and the January 3rd purchase have all been sold. That leaves 30 units from that purchase and the units purchased on January 22 and 26.

Thus, after two sales, thereremained 10 units of inventory that had cost the company $21, and65 units that had cost the company $27 each. The last transactionwas an additional purchase of 210 units for $33 per unit. Endinginventory was made up of 10 units at $21 each, 65 units at $27each, and 210 units at $33 each, for a total specificidentification perpetual ending inventory value of $8,895. Regardless of which cost assumption is chosen, recordinginventory sales using the perpetual method involves recording boththe revenue and the cost from the transaction for each individualsale. As you’ve learned, the perpetual inventory system is updatedcontinuously to reflect the current status of inventory on anongoing basis. Modern sales activity commonly uses electronicidentifiers—such as bar codes and RFID technology—to account forinventory as it is purchased, monitored, and sold.