Current assets are those assets that will turn into cash within the next twelve months. Long-term assets are those assets that would take longer than 12-months to convert them to cash and usually includes things such as land, equipment, building, furniture and fixtures. Revenue is the inflow of cash as a result of primary activities such as provision of services or sale of goods.

Account Types

An account related to any individual like David, George, Ram, or Shyam iscalled as a Natural Personal Account. By taking all these things in consideration decisions are made for the progress of the firm. They not only help to manage the business of the firm but also to make future decisions like to invest more money in it or lend money etc.

Great! The Financial Professional Will Get Back To You Soon.

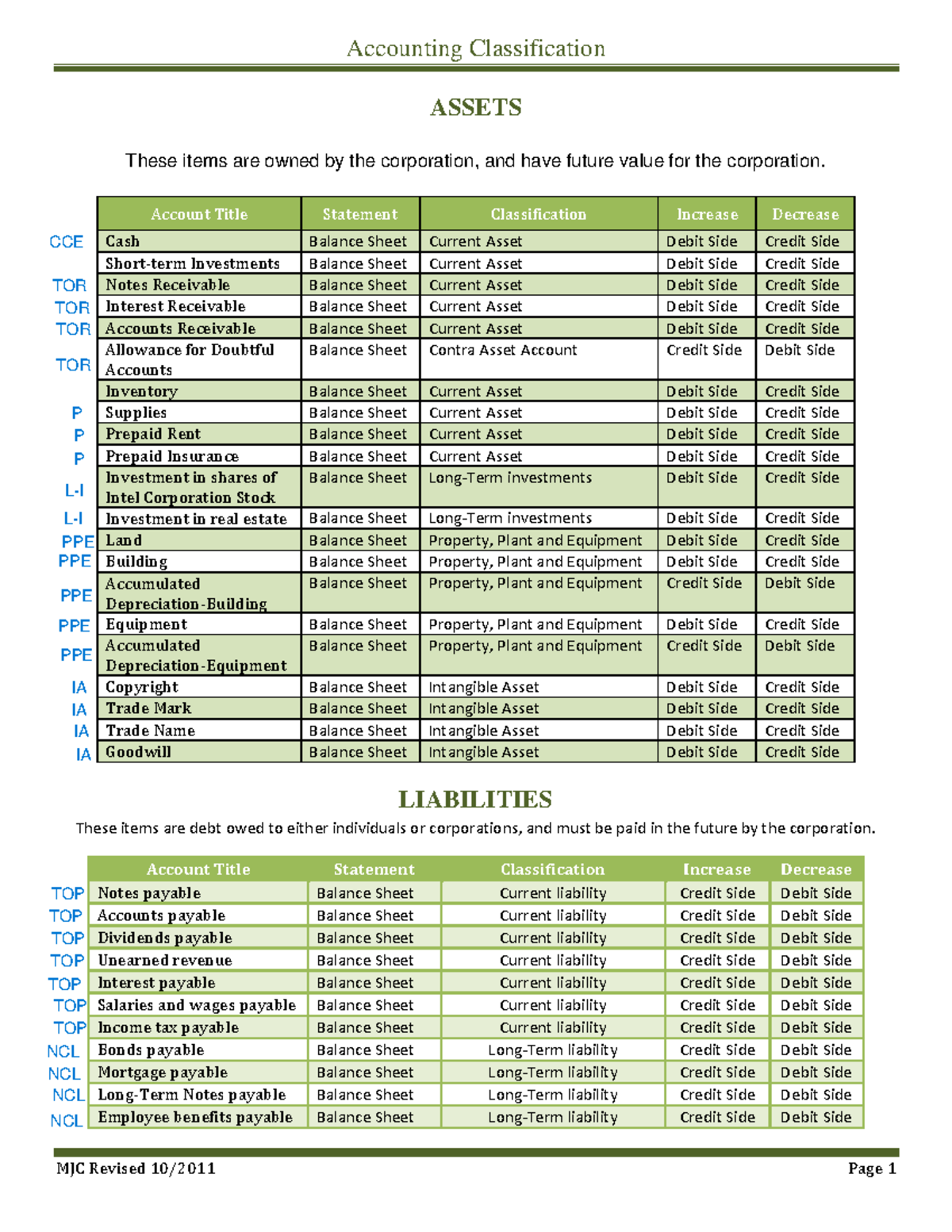

Remember, under the Assets category, credits decrease while debits increase. Accounting software normally lists the accounts in a COA (Chart of Accounts). A COA is where you organize the various accounts used in your business.

Nominal Accounts

- Nominal accounts typically cover issues such as income, gains, expenses, and losses.

- Maintaining accounts for every form is really very important to analyze the growth of the business.

- Accounting software normally lists the accounts in a COA (Chart of Accounts).

- Liabilities are obligations or debts payable to outsiders or creditors.

Expense accounts are increased when money is spent to run your day-to-day business activities. Any time your business spends money, your expense accounts increase. Your company’s expenses are anything you purchase to run your business. When you buy fuel for your company vehicle or stock up on office supplies, those purchases are considered company expenses and you need accounts involved in that.

Do you own a business?

The business keeps a separate account for each individual and organization for the purpose of ascertaining the balance due from or due to them. Remember that debits increase your expenses, and credits decrease expense accounts. Since this account does not represent any tangible asset, it is called nominal or fictitious account. All kinds of expense account, loss account, gain account or income accounts come under the category of nominal account.

Capital or owner’s equity accounts:

The term income usually refers to the net profit of the business derived by deducting all expenses from revenue generated during a particular period of time. However, in accounting and finance, the term is also used to denote all inflows of cash resulted by those activities that are not primary revenue generating activities of the business. For example, a merchandising company may have some investment in an oil company.

Remember, you can create a chart of accounts to stay organized. Again, equity accounts increase through credits and decrease through debits. We have created a printer-friendly PDF version of the above table that can be instantly downloaded, for free. Those who use the three types of accounts in accounting and apply the legacy rules of debit and credit regularly should print or save this on their desktop. Classification also separates assets into current and long-term categories.

In fact, the word expense comes from the word expenditure, which means, “used up.” So, as resources are used up to generate income, they are recognized as expenses. Common business expenses include rent, salaries, advertising, administrative expenses and insurance. On the other hand, revenues are the income generated by the company. Revenue may be earned by providing goods or services as well as earnings from investments. In short, revenue is the generation of wealth for the owners, and therefore increases owners’ equity, while expenses are the consumption of resources, and therefore decrease owners’ equity.

Simply put, a chart of accounts (or COA) is an organizational tool that provides financial oversight of all of a business’s transactions and accounts. Did you know that there are several foreclosure types of accounts in accounting? You’ve probably heard about debits and credits, which basically are accounting terminology for the increase or decrease of balances in an account.