This helps ensure consistency and comparability in financial reporting. Other Comprehensive Income includes gains and losses that have not yet been realized but are online payroll submission included in shareholders’ equity. Separating Other Comprehensive Income allows businesses to track changes in the value of certain assets or liabilities over time.

Seller SKU Amazon: What is Amazon Seller SKU? Explore Ways to Create and Manage it

Simple record-keeping systems started appearing in the late Middle Ages and early Renaissance, thanks to merchants and traders who needed to somehow track their transactions and finances. The COA has been a fundamental component of accounting systems for centuries, evolving with accounting practices. While we can’t name the exact date when it became a standard accounting practice, we can trace its evolution through history – from tally sticks to accounting software. Equity is the ownership value in a company, determined by subtracting liabilities from assets.

- Each account in this example can be further detailed or expanded based on the specific needs of the business, such as adding separate accounts for different types of services or inventory.

- Comprehensive training for staff on using integrated systems is crucial.

- Small businesses use the COA to organize all the intricate details of their company finances into an accessible format.

- Contra accounts are used to provide a more accurate representation of the related accounts.

- An easy way to explain this is to translate it into personal finance terms.

What is the approximate value of your cash savings and other investments?

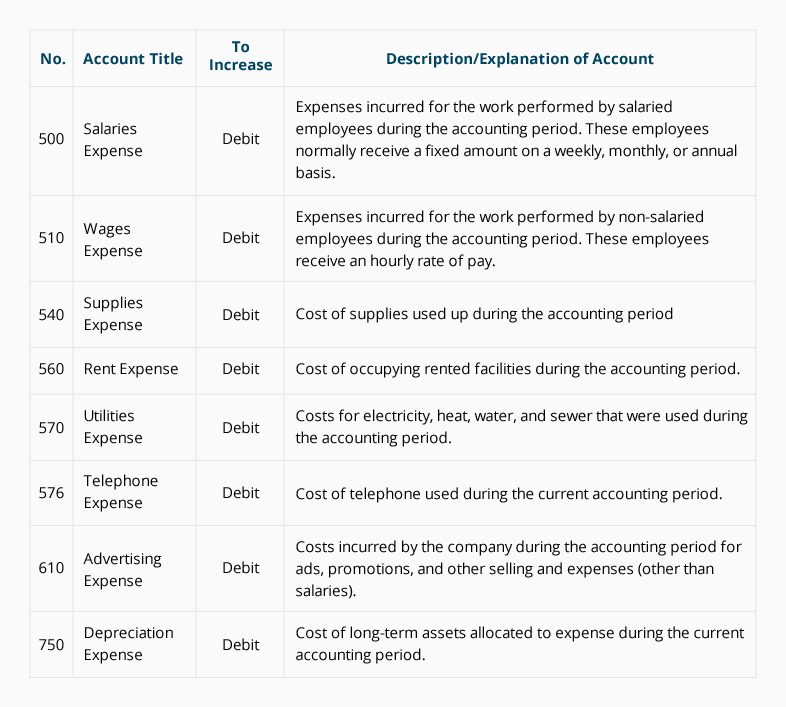

Small businesses may record hundreds or even thousands of transactions each year. A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions. Ultimately, it helps you make sense of a large pool of data and understand your business’s financial history. This numbering system helps bookkeepers and accountants keep track of accounts along with what category they belong two. For instance, if an account’s name or description is ambiguous, the bookkeeper can simply look at the prefix to know exactly what it is. An account might simply be named “insurance offset.” What does that mean?

Where’d you go to find equity?

Clear, standardized naming ensures uniformity across accounts, making it easier for users to locate and understand different accounts’ purposes. These standards provide guidelines for financial reporting, including the structure of the COA. So, separating these additional accounts allows businesses to understand the specific drivers of their financial performance in more detail. The chart of accounts deals with the five main categories, or, if you will, account types.

Download Chart of Accounts Example Template (Excel included)

As mentioned above, equity is one of the so-called balance sheet accounts, as it appears in the balance sheet. Equity is listed alongside liabilities, representing the shareholders’ stake in the company’s assets. The total equity amount reflects the company’s net worth or book value, which is the value of the assets minus the liabilities.

Is There a Single COA Format?

Larger businesses may have more detailed accounts, including more specific sub-categories. The COA should be tailored to fit the unique accounting needs of each business, capturing all relevant financial activities. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health.

It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized. If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts. Doing this will help you stay organized and better understand how your business is doing financially. A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. The list typically displays account names, details, codes and balances. There’s often an option to view all the transactions within a particular account, too.

Yes, it is a good idea to customize your chart of accounts to suit your unique business. Business owners who keep a chart of accounts handy will have an advantage when it comes to accounting. The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types. It also lays the foundation for all your business’s important financial reports. Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate line items in your chart of accounts for different types of income. This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense.

In simple terms, it’s what you have in the business as a company owner (or one of the company owners) or, often, an investor. Current liabilities are short-term debts (a company should pay off within a year), like bills and short-term loans. Long-term loans or leases and other long-term obligations (usually due beyond a year) are non-current liabilities.

It’s also worth saying that depending on the idustry and a business’s structure, more accounts can form the COA. The standard chart of accounts requires you to present your finances divided into several groups – accounts – representing various aspects of your business activities. So, when setting up your accounting system, you create the COA in this order. Meanwhile, let’s look at the general ledger real quick because general ledger uses the accounts listed in the chart of accounts to record and organize financial transactions. The chart of accounts, at this point, serves as a structure under which the general ledger operates. In accounting and bookkeeping, we use the term accounts for categories under which you typically record your business’s financial activities.