Inlanta Financial

Inlanta Home loan are built by John Knowlton into the 1993. ” Regardless of if it business attitude may have to alter, as the lender was

. Terms of the offer haven’t been announced. Prior to now, Inlanta keeps acquired several prizes to possess best urban centers to your workplace and outstanding customer care. It has reverse mortgage loans, variable rate mortgage loans, repair funds, government and you can traditional points. As a result of its acquisition, the lending company, which was respected during the $90 million, could have been renamed so you’re able to Guild Mortgage Inlanta.

Wave Mortgage

The brand new quickly growing lender have twigs strewn along side 47 says it lends inside, but retains large presences from the Carolinas, Tx, Kansas, Texas and you will Arizona, told you creator and https://www.clickcashadvance.com/payday-loans-fl/memphis/ President Tony Grothouse. Conforming money create 78% of Revolution’s originations, additionally the firm try dealing with yet another design device. The company keeps three big annual events as well as a golf event, and you will keeps companionship large having products including food and products to own the pass on-out workforce.

“All of our community is truly dependent around one easy keyword,’ he said. “It is more about profitable. Its a fantastic people, and extremely the art of all of our individuals to serve, serving and you will successful go hands-in-hands for us.”

Embrace Lenders

Embrace Lenders, mainly based from inside the 1983 “with a couple away from reddish legal pads and another shiny typewriter,” was an entire solution all over the country lending company located in Middletown, Rhode Area. The company, that has been dependent by Dennis F. Hardiman, to start with try entitled State-of-the-art Financial Characteristics. During 2009, following acquisition of Mason dixon Financing, the organization e just after comprehending that “the client dating begins and stops that have an embrace.”

Incorporate Lenders now offers a variety of home loan issues ranging from conventional, regulators, jumbo and you can construction money. For its staff, the business offers aggressive settlement and benefits, and a yearly 401k profit sharing share.

The common tenure out-of a hug financing officer is simply over eight age, versus business average around a couple of years, with respect to the team spokesperson. In addition, the business prides itself towards the giving a percentage of the money so you’re able to charity, with well over $twenty-five billion being donated on teams it caters to across the earlier several years.

Financial Traders Classification

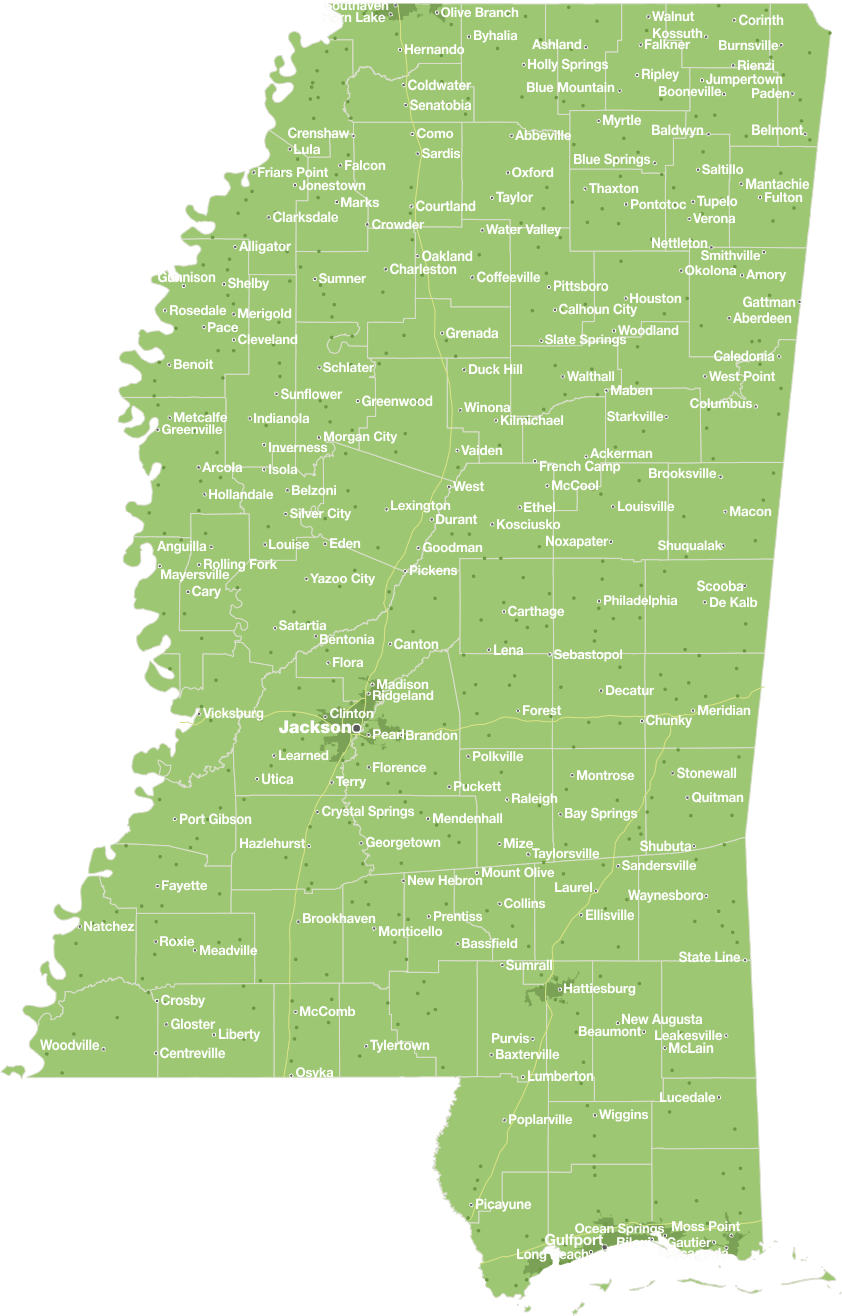

Which have a newbie of the day prize and you may a trip to possess the better brands, Southeast lender Financial Dealers Class has the benefit of a powerful roster from detection applications including individual advancement and fret administration courses. The business are built for the 1989 because of the Chuck Tonkin and you can Chief executive officer Chrissi Rhea.

Home loan Network

for the . During the time of it composing, Movement got verified the acquisition got closed however, don’t act to help expand wants comment. Financial Network got a statement posted towards its web site proclaiming that its mortgage administrator, processor, underwriting and you will closing party was still positioned article order and is implementing Movement’s technology system and provides an extensive a number of fixed and you may hybrid adjustable-speed mortgages. Mortgage issues indexed incorporated authorities-supported mortgages, jumbo, recovery, outlying and you may home security financing.

Newfi Credit

Emeryville, California-mainly based Newfi Credit are a customer lead and wholesale lending company that is “invested in enabling borrowers money their futures across the country.” The business was depending inside the 2014 by the Steve Abreu.

Newfi now offers simple capital choice together with traditional and you may bodies loans, exactly what causes it to be stay ahead of competition is its “easy,innovative mortgage choice,” starting from some non-qm money, jumbo funds and you will variable home loan affairs. “In the centre of it, our company is most agile and get made tall globe device designs which make people love arriving at work,” a family representative said.