A Thrift Coupons Bundle (TSP) is actually a retirement package open to uniformed service participants otherwise group of the national. A teaspoon loan lets people in a teaspoon senior years intend to borrow on their own old-age coupons and is exactly like an excellent 401(k) mortgage.

Having qualified individuals who are in need of more income to invest in a huge or unexpected expense, a tsp mortgage are going to be a medical solution.

What is a tsp mortgage?

A tsp loan is a type of loan enabling government staff or uniformed provider players so you’re able to use off their Thrift Coupons Plan. As you’re credit out of your offers, its usually easy to be eligible for a teaspoon financing, even if you need fill in most files if you undertake to use your loan funds to possess home-based objectives.

Teaspoon loans allow you to borrow out of $step 1,000 in order to $fifty,000, offered you really have sufficient currency secured in your Teaspoon. You’ll have all in all, five years otherwise fifteen years so you can pay back the amount of money with a predetermined interest rate, depending on the loan’s explore, and you will money will be instantly withdrawn out of your paycheck.

- General purpose. These finance are used for any purpose, none of them documents and also a repayment term of just one so you can 5 years.

- Residential. Utilized merely on the acquisition otherwise build off an initial household, this form demands records and contains a cost title of 1 so you’re able to 15 years.

How do Teaspoon financing really works?

That have a teaspoon financing, you are essentially credit the currency having a designated period of time to blow they right back. This new Tsp loan rates energized was equivalent to brand new Grams Funds price (Bodies Ties Investment Money) throughout the day the loan are accepted.

Like an effective 401(k) financing, after you pay attract charges on the a teaspoon mortgage, you are investing them to on your own instead of to a financial otherwise lender because most of the currency paid back goes back on pension membership.

The way to get a teaspoon loan

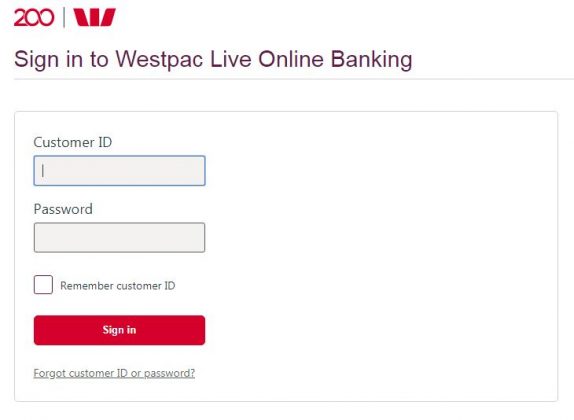

You could sign up for a teaspoon mortgage online of the signing to the “My Membership” on . You are in a position to finish the entire loan application processes on the internet. But not, you’re expected so you can printing the loan demand. If the motivated in order to print the applying, make certain that most of the industries is right, and can include most files which is questioned of you. You may either upload the latest files toward Tsp membership otherwise send they from the send or fax.

Whether you are expected to print out the form hinges on good pair products. Such as, your own marital status, the fresh new Tsp loan style of questioned, otherwise just how you have opted for the mortgage financing.

When you find yourself a national Group Old age Program fellow member otherwise a great uniformed solution user as they are married, your spouse need signal the mortgage Contract so you’re able to denote its agree. Similarly, your spouse is notified while you are deciding on a great Tsp loan because the a civil Services Senior years System participant. Into the rare circumstances, there have been conditions to Teaspoon loan legislation regarding spousal concur.

Tsp financing qualifications conditions

Both for type of Tsp money, you need to be a great uniformed service affiliate otherwise a national employee. While doing so, you should:

- Keeps a minimum of $step 1,000 of one’s contributions on your Teaspoon membership.

- Not have reduced a tsp financing of the same enter in during the last two months.

- Get into pay position, given that Teaspoon loan costs could well be subtracted from your salary.

- Not have got a nonexempt distribution towards the that loan during the past 12 months unless of course its linked to their break up of federal solution.

- Simply have one to general purpose Tsp loan plus one residential Tsp loan per account any moment.

- N’t have a legal acquisition put against your Teaspoon account.

If you get a tsp loan?

Weighed against other sorts of fund, Tsp finance are fairly low exposure – interest levels was reasonable, and you’re borrowing off on your own in the place of regarding a loan provider. If you would like borrow funds getting a purchase that you can’t afford out of pocket, a teaspoon loan is a great service.

- There was good $50 control fee each financing, and is subtracted from the amount borrowed.

Additionally need certainly to always find the money for pay-off the month-to-month Teaspoon loan repayments. Utilize the Thrift Savings Package financing costs calculator to ascertain how much you may shell out monthly.

Cons of a tsp financing

For example, as opposed to most other credit solutions, such a vintage personal loan, Teaspoon loans would not make it easier to build otherwise change your credit because payments are not stated towards the credit bureaus. Tsp mortgage money will be taxed due to the Brent loans fact income double, as previously mentioned above – immediately after to your loan and you will once more through to disbursement later on during the old age.

Finally, a significant risk is if you leave your federal job with an outstanding loan. In this situation, you’ll either have to pay it back in one lump payment or otherwise face default, which can lead to other tax- and credit-related complications. Show full articles without “Continue Reading” button for <0>hours.