Faqs In the DACA Lenders

If you’re a DACA person, you should buy a home loan. If you are certain kinds of funds is unavailable to help you Dreamers, traditional loans is a choice for anyone in the nation significantly less than the DACA program. Whenever getting a conventional financial for your pick, you are going to essentially gain benefit from the same experts while the any candidate, also large financing restrictions and you may realistic borrowing criteria.

Using a traditional home loan as good DACA individual, you have the means to access a similar financing limits since people You.S. citizen making use of this sort of resource. The specific number which you have access to is dependent upon your income, debt-to-money proportion, credit history, or any other facts, nevertheless limit all over the country try $510,400 to own one-home. In a few high-pricing portion, the brand new maximum can go as high as $765,600. (Again, not everyone usually be eligible for that amount, but those individuals may be the federal constraints.)

As compared to a normal traditional financing to possess good U.S. citizen, zero, there is not lots of paperwork to have DACA lenders. You’ll have to confirm the reputation because the an effective DACA receiver, and you may have to go from exact same application process since others, but you will perhaps not pick excessive papers with it financial.

Even though you try self-functioning and do not have regular paystubs and you can tax statements, you can nevertheless make use of this financial. DACA recipients was in exact same very first certification standards, while almost certainly won’t need a couple of-numerous years of thinking-employment in order to meet the requirements, as is are not considered.

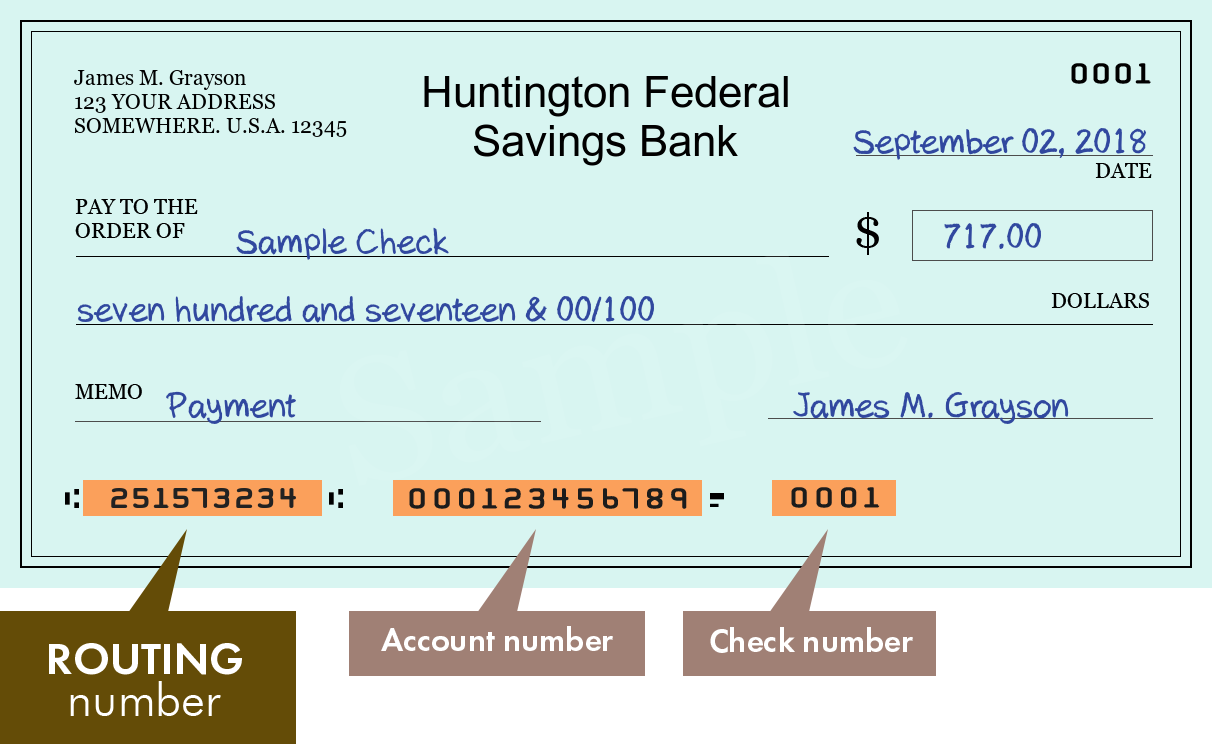

And your income, credit, and you can financial obligation recommendations, DACA readers will have to be sure the status in the united kingdom, that can be done by way of a jobs Consent File, Eco-friendly Cards, Visa, or other recommendations. You may want to you desire shell out stubs, a job verification, your Social Coverage cards, otherwise bank statements. Generally, you need to have the ability to of those data ready however if they are asked by the credit representative.

six. Question: Easily (or an excellent Dreamer family member) only speak Foreign-language, ought i however done a loan application to possess a home loan?

If you work with all of us for the DACA home loan, you can purchase the expertise of a good bilingual elite who’s knowledgable about the financing-application processes. Our company is serious about deciding to make the software processes as the smooth, much easier, and you may obvious that one can, therefore we is actually happy to give our americash loans Valley Head characteristics to those whom only speak Foreign language.

While you are government coverage is definitely susceptible to alter, FHA fund are currently not available to help you non-owners. The newest Agencies out-of Houses and Urban Creativity, hence oversees this new Government Casing Administration (FHA), keeps generally reported that the properties are only readily available for U.S. people, as they are maybe not, based on a page published by one of their agents, on the market out of deciding citizenship. For much more on this subject, delight understand our very own post on the FHA loans and you may DACA users .

8. Question: If my personal credit score on the You.S.A is not large, must i still get a mortgage as a great Dreamer?

If you get a conventional loan, you are at the mercy of the same financial criteria just like the virtually any mortgage. Regardless of if standards can differ of the financial, the government, Federal national mortgage association, and Freddie Mac computer lack additional criteria for making use of such financing beyond verifying your own home status. Consequently youre subject to an equivalent credit criteria because any other applicant.

To use a normal financing, you want a credit rating regarding 620 or higher in the most common cases. This is simply not a highly lower score, but it is not a leading score sometimes. Essentially, demanding a beneficial 620 get otherwise most readily useful implies that most people, plus DACA readers, usually qualify for your house financing.

nine. Question: A close relative gave me a money gift. Should i utilize this since the my personal down-payment or financial charge?

When selecting a home, many people have trouble with the brand new down payment requirements. In many cases, certain requirements is as high once the 20% (which is extremely uncommon), however, even a good step 3.5% down-payment is going to be tough; during the a cost out of merely $two hundred,000, 3.5% is short for $eight,000.

To relieve the duty, most people play with cash gift suggestions away from nearest and dearest. However, you will find limitations, as the lenders, generally speaking, prefer the deposit money originates from personal deals and you will financial investments, as this reveals a particular amount of monetary obligation. But cash merchandise may be used to your traditional finance, which means DACA users using this type of program also can funds downpayments and you will charge having a present.

The first step in purchasing a property just like the a beneficial DACA person is to find prequalified for a conventional loan. The procedure is simple and, and receiving prequalified allows you to shop for residential property that have better appeal and depend on.

While you are prequalified, you have better usage of getting-deals homes, as much vendors and you can seller agents merely focus on prequalified buyers. you will keeps a very clear notion of your current finances, making you a more advised buyer. Whether you are a beneficial You.S. resident or a great Dreamer, bringing prequalified is the starting point.

Dreamers: Score a home loan Easily towards FastTrack Program

Using the FastTrack program, we could help you get an interest rate efficiently and quickly, without having to sacrifice quality and you can cost.

If you’re ready to look for your property, get in touch with North park Buy Financing now. We’re going to definitely have the right information and also make an effective pretty sure choice, so let’s help you get prequalified now!