Borrowing unions and you may financial institutions try siblings, maybe not twins. Which is the best thing. They show a similar DNA, however, per provides novel and you can undeniable perks that help you personalize their banking feel.

When deciding to take full advantageous asset of people benefits, you should know the essential difference between the 2. Although we creditunion), we believe visitors should have the knowledge they need to be economically pretty sure, wherever they financial. Very in place of subsequent ado, this is what you should know before choosing a loan company.

The new #step 1 Difference between Borrowing from the bank Unions and you may Financial institutions

You can find items that put borrowing from the bank unions and finance companies aside, but the majority of these stem from one main difference: Borrowing from the bank unions such Idaho Main services since a no further-for-cash, and you can banking institutions efforts under a for-money business design.

Since the perhaps not-for-funds teams, borrowing from the bank unions are responsible for going back worthy of on the players. They won’t spreading winnings to investors; as an alternative, it for profits back once again to the financing commitment to progress the newest organization’s goal, that the instance was Enabling players get to monetary achievement. One extra is usually returned to members in the way of all the way down charge, top interest levels, otherwise enhanced attributes.

As for-money groups, finance companies have the effect of generating funds because of its citizens or investors. Rather than nonprofits and never-for-winnings, banking companies is actually passionate by the that overarching objective – enhancing stockholder really worth and you may coming back returns on the dealers.

Except that Earnings, are Borrowing from the bank Unions and Finance companies an identical?

Not-for-cash against. for-money banking might not appear to be a crazy huge difference, but just such as for example family genes inside the sisters, a small adaptation can cause polarities in the future.

Build

Borrowing Unions: Borrowing from the bank unions explore a bottom-upwards ework. Per user provides the same choose throughout the credit union’s ount of money he’s transferred. Users is actually portrayed by a volunteer panel from administrators, constantly comprising borrowing from the bank partnership participants.

Banks: Because banking companies try owned by shareholders exactly who predict a profit with the their investment, they often fool around with a leading-down method, leaving large-level conclusion to the new shareholders themselves.

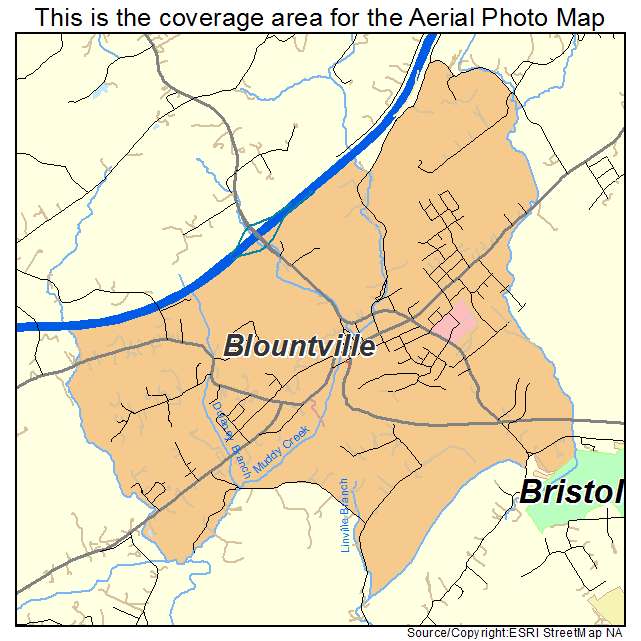

Supply and you can Branch Network

Borrowing Unions: Borrowing from the bank unions might have an even more limited department and you may https://paydayloanflorida.net/mount-dora/ Atm network, particularly when he could be community-built. Yet not, of numerous borrowing unions be involved in mutual branching networks and supply mobile banking, allowing members to access qualities regarding subsequent out.

Rates of interest, Charge, and Attributes

Credit Unions: Borrowing unions have a tendency to give down costs and more competitive interest levels into the finance and you can savings account, as his or her goal would be to work for the users instead of generate payouts.

Banks: Banking institutions have higher costs and you may rates of interest with the money and you can handmade cards, because they aim to maximize earnings to have investors. Due to this fact, they truly are commonly capable promote characteristics particular credit unions try not to due to the fact they have usage of shareholder financial support.

Subscription Qualification

Borrowing from the bank Unions: Borrowing unions features membership conditions, tend to considering a common thread such as for example staying in good specific society, helping a similar employer, or belonging to a specific team.

Controls

Borrowing from the bank Unions: Borrowing from the bank unions is managed from the National Borrowing from the bank Relationship Administration (NCUA) at the federal level and may be susceptible to condition statutes.

Banks: Banking companies is actually managed by federal and state financial bodies, such as the Government Reserve while the Office of Comptroller of your own Currency (OCC).

Do i need to Bank which have a cards Relationship?

Just as in extremely financial questions, the response to this new dilemma of borrowing unions compared to finance companies is based toward who you are and you will everything predict from your own financial institution:

- Most readily useful customer service

- Greatest rates and costs

- Belonging to the professionals

- Image because of a panel out-of volunteers

- Prevalent accessibility

- A great deal more assortment from inside the services

- Is easier to lender internationally

- Zero registration conditions to participate

While we of course stand behind brand new pros out-of borrowing unions, i advise you to take time to consider what financial features your believe in really before making a decision locations to bank.

We love being a credit commitment due to just what it form to our players, the teams, additionally the Pacific Northwest. As the more substantial credit connection, we have been positioned to offer members multiple qualities without sacrificing one to quick-urban area customer service we have been recognized for. Which is our sweet destination, all of our happy set – finding a method to promote our members the very best opportunity to-arrive monetary success, no matter how or in which we expand.

Psst … Interested in enrolling in Idaho Central? Find out if you are permitted subscribe because of the pressing the switch less than.