The specific accounts and subcategories will vary depending on the business type and industry. The main accounts within your COA help organize transactions into coherent groups that you can use to analyze your business’s financial position. In fact, some of the most important financial reports — the balance sheet and income statement — are generated based on data from the COA’s main accounts. Analyzing a balance sheet typically involves understanding the company’s liquidity, solvency, and overall financial health.

Organise account names into one of the four account category types

Second, let’s see how the journal entries feed into the general ledger which feeds into the trial balance. At the end of the year, review all of your accounts and see if there’s an opportunity for consolidation. Here’s how to categorize transactions in QuickBooks Online and navigate the COA.

Ask Any Financial Question

- That doesn’t mean recording every single detail about every single transaction.

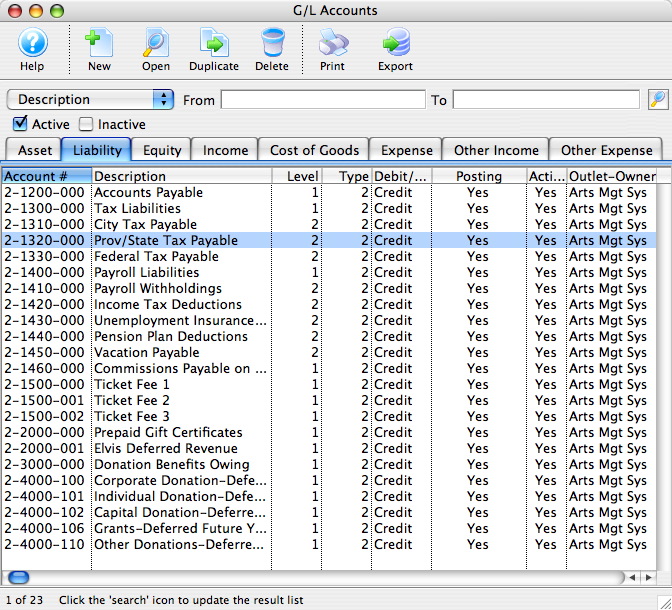

- If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts.

- Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account.

An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes. COAs are typically made up of five main accounts, with each having multiple subaccounts. The average small business shouldn’t have to exceed this limit if its accounts are set up efficiently.

What are the best practices for integrating a chart of accounts with accounting software or ERP systems?

A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and present value of future benefits how long it should last you given your average monthly business expenses. Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger.

Summarizing Accounts for Financial Statements

It includes assets, liabilities, and owners’ equity, making it a valuable tool for understanding a company’s resources and financings. Assets represent what a company owns, liabilities represent what a company owes, and owners’ equity represents the shareholders’ investment. If you’ve worked on a general ledger before, you’ll notice the accounts for the ledger are the same as the ones found in a chart of accounts.Keeping your books organized does not need to be a chore.

These include accounts payable, wages, taxes owed, and current portions of long-term debt which are crucial for managing immediate financial responsibilities. Importantly, the COA is designed to be adaptable, evolving with the business to include new accounts as necessary, ensuring its continued relevance. We offer a range of business templates and software products to make sure you’re prepared for all of your business needs.

Exclude nonoperating income, such as interest, in your revenue accounts. Owner’s equity is the owner’s rights to the assets of the business or what’s left over after subtracting the liabilities from the assets. It includes money invested by the owner of the business plus the profits of the business since its inception.

With a chart of accounts numbering system, each account is allocated a code depending on the complexity of the business and the amount of detail required from its financial reporting system. The purpose of the numbering system is to group similar accounts to provide an easy method of remembering and referring to an account when preparing journal entries. Noncurrent liabilities are obligations due beyond one year or the company’s operating cycle.