In summary, while the NPV profile is a valuable tool, it’s essential to recognize its limitations. Combining it with other evaluation methods and considering qualitative aspects ensures a more holistic decision-making process. Remember that no financial model can perfectly predict the future, but thoughtful consideration of these limitations can enhance our understanding of investment projects.

Calculating the NPV of an MBA Program

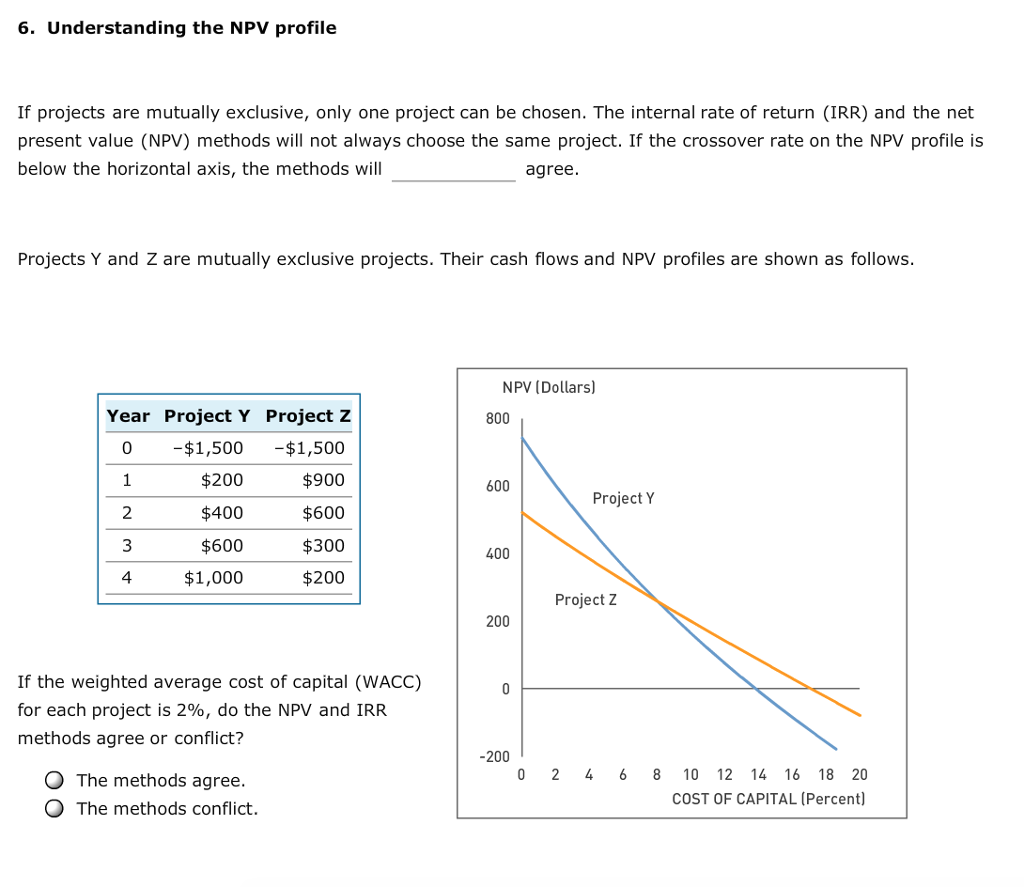

Plotting this NPV Profile on a graph will show us the relationship between these projects. Using these points, we can also calculate the crossover rate, i.e., the rate at which the NPV of both projects is equal. If the net present value of a project or investment is negative, then it is not worth undertaking, as it will be worth less in the future than it is today. NPV allows for easy comparison of various investment alternatives or projects, helping decision-makers identify the most attractive opportunities and allocate resources accordingly. By comparing NPVs, decision-makers can identify the most attractive investment opportunities and allocate resources accordingly. These rules are applicable when it is assumed that the company has unlimited cash and time to accept all projects that come in their way.

Subtract Initial Investment From Sum of Present Values

On the other hand, Project Y performs better at 5%, 10% as well as 15% as the discount rate increases the NPV declines. This is also true in the real world when the discount rate increases, the business has to put more money into the project; this increases the cost of the project. The steeper the curve, the more the project is sensitive to interest rates. So, JKL Media’s project has a positive NPV, but from a business perspective, the firm should also know what rate of return will be generated by this investment.

Net Present Value (NPV) Calculation

This concept is the foundation of NPV calculations, as it emphasizes the importance of considering the timing and magnitude of cash flows when evaluating investment opportunities. Meanwhile, today’s dollar can be invested in a safe asset like government bonds; investments riskier than Treasuries must offer a higher rate of return. However it’s determined, the discount rate is simply the baseline rate of return that a project must exceed to be worthwhile. When using the NPV profile to evaluate investment projects, it is important to consider the project’s specific requirements, risk tolerance, and strategic objectives. By comparing the NPV profiles of different projects, decision-makers can prioritize investments based on their financial viability and alignment with organizational goals.

- Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

- The discount rate value used is a judgment call, while the cost of an investment and its projected returns are necessarily estimates.

- Remember that no financial model can perfectly predict the future, but thoughtful consideration of these limitations can enhance our understanding of investment projects.

- It embodies the essence of informed decision-making—a blend of financial acumen, risk assessment, and strategic foresight.

As long as interest rates are positive, a dollar today is worth more than a dollar tomorrow because a dollar today can earn an extra day’s worth of interest. Even if future returns can be projected with certainty, they must be discounted because time must pass before they’re realized—the time during which a comparable sum could earn interest. If you are confident that the firm’s cost of attracting funds is less than 14%, the company should accept the project.

From the perspective of investors, the NPV profile offers a clear picture of the project’s potential returns and risks. By plotting the npv against the discount rate, one can identify the rate at which the project becomes economically feasible. This information aids in determining the project’s attractiveness and its alignment with the investor’s financial goals.

Therefore, when evaluating investment opportunities, a higher NPV is a favorable indicator, aligning to maximize profitability and create long-term value. To construct an absorption costing explained with pros and cons and example for Sam’s, select several discount rates and compute the NPV for the embroidery machine project using each of those discount rates. Notice that if the discount rate is zero, the NPV is simply the sum of the cash flows. As the discount rate becomes larger, the NPV falls and eventually becomes negative. Theoretically, we should use the firm’s cost to attract capital as the discount rate when calculating NPV. In reality, it is difficult to estimate this cost of capital accurately and confidently.

Projects with positive NPV profile are considered the ones which maximize the NPV and are the ones selected for investment. IRR is usually more useful when you are comparing across multiple projects or investments, or in situations where it is difficult to determine the appropriate discount rate. NPV tends to be better for when cash flows may flip from positive to negative (or back again) over time, or when there are multiple discount rates. No matter how the discount rate is determined, a negative NPV shows that the expected rate of return will fall short of it, meaning that the project will not create value. Sam’s purchasing of the embroidery machine involves spending money today in the hopes of making more money in the future. Because the cash inflows and outflows occur in different time periods, they cannot be directly compared to each other.

Because the discount rate is an approximate value, we want to determine whether a small error in our estimate is important to our overall conclusion. We can do this by creating an NPV profile, which graphs the NPV at a variety of discount rates and allows us to determine how sensitive the NPV is to changes in the discount rate. Suppose your company is considering a project that will cost $30,000 this year.

Remember that context matters—consider industry norms, project specifics, and risk tolerance. Armed with this knowledge, you can confidently navigate the financial landscape and optimize your project portfolio. If two projects are mutually exclusive, the discount rate is considered as the deciding factor to differentiate between the projects. The net present value rule is the idea that company managers and investors should only invest in projects or engage in transactions that have a positive net present value (NPV).