This means that each share of stock would be worth $1 if the company got liquidated. BVPS relies on the historical costs of assets rather than their current market values. This approach can lead to significant discrepancies between the book value and the actual market value of a company’s assets.

How does BVPS differ from market value per share?

- Lastly, observing changes in a company’s book value per share over time can indicate a company’s health or management effectiveness.

- The book value of a company is the difference between that company’s total assets and total liabilities, and not its share price in the market.

- Market demand may increase the stock price, which results in a large divergence between the market and book values per share.

- However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading.

It’s crucial to delve deeper when interpreting book value per share to understand the specific factors contributing to its increase or decrease. Taking a holistic approach will provide a clearer picture of a company’s financial health. While book value per share can offer valuable insights, it’s only one piece of the puzzle. It should be used in conjunction with other financial metrics to make a comprehensive investment decision.

Methods to Increase the Book Value Per Share

Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share. It may not include intangible assets how to obtain a copy of your tax return 2020 such as patents, intellectual property, brand value, and goodwill. It also may not fully account for workers’ skills, human capital, and future profits and growth.

All About Investment Concepts on smallcase –

If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases. If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders.

Book Value Per Share Calculation Example (BVPS)

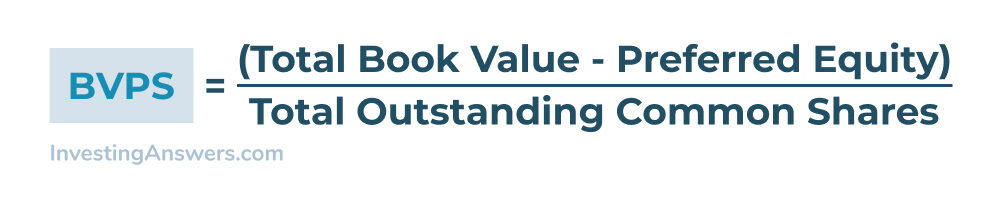

Total annual return is considered by a number of analysts to be a better, more accurate gauge of a mutual fund’s performance, but the NAV is still used as a handy interim evaluation tool. Let’s say that Company A has $12 million in stockholders’ equity, $2 million of preferred stock, and an average of 2,500,000 shares outstanding. You can use the book value per share formula to help calculate the book value per share of the company.

The calculation of book value per share is relatively simple, making it easily accessible and understandable for investors and analysts. The book value per share is just one metric that you should look at when considering an investment. It’s important to remember that the book value per share is not the only metric that you should consider when making an investment decision.

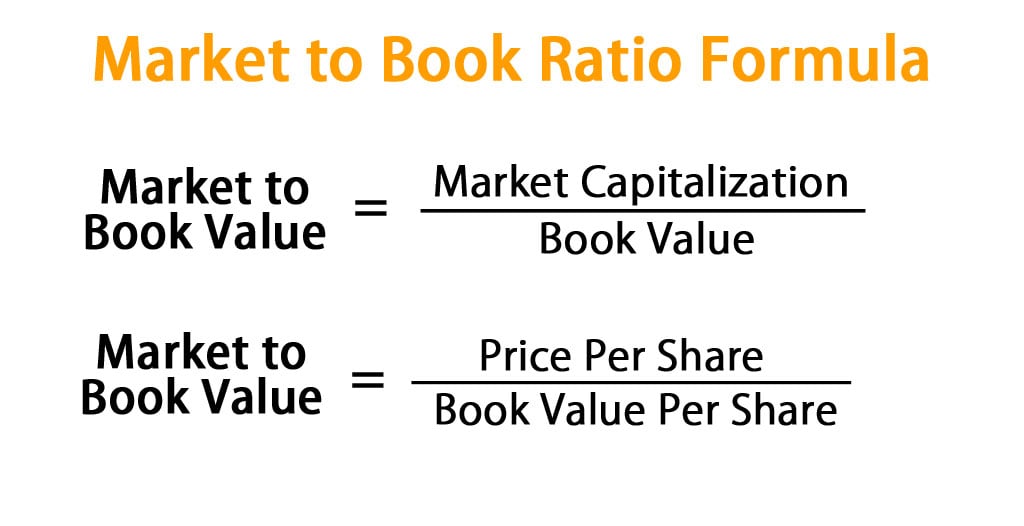

It takes into account the company’s total assets and subtracts any outstanding liabilities, measuring the net assets that the shareholders would theoretically receive if the business were liquidated. Consequently, the book value per share can be seen as the minimum value of the company’s shares. Book value per share relates to shareholders’ equity divided by the number of common shares. Earnings per share would be the net income that common shareholders would receive per share (company’s net profits divided by outstanding common shares). In addition, stocks below book value might signal an undervalued asset, presenting an opportunity to acquire shares at a discounted rate.

A company that fails to reinvest its earnings might have a high book value from accumulated earnings, but this could potentially harm future growth. High book value without reinvestment could indicate stagnation or lack of strategic planning. Therefore, investors typically prefer companies that balance between maintaining high book value and reinvesting for growth. In industries where the value of intangible assets, such as technology or intellectual property, significantly contributes to a company’s worth, book value per share may provide limited insights. In the world of finance, understanding a company’s worth is crucial for investors and stakeholders. The book value per share serves as an important measure that helps determine the intrinsic value of a company’s shares.