Work-existence equilibrium ily, particularly if you’re a high-performer at your industry. Its burdensome to look at their kids develop and never see quality date using them as you learn you should. This can be an informing signal to purchase your earliest trips assets.

When you very own your vacation family, enjoying the coastline, walking, or other leisurely things is largely. Your throw out the trouble to find offered bookings by the riding in order to a gentle home you already own.

To qualify for a decent trips possessions financial rate, you can find standards to meet. The never ever-stop vacation is actually waiting for you. Here’s what you must know regarding the travel home loan criteria when deciding to take the plunge.

How can you Make use of the Domestic?

The way you propose to explore a home establishes the to order processes and you can specific mortgage criteria. You’ll find step three classes your property may fall into: number 1, supplementary, otherwise investment property.

Being aware what particular house your trip property usually show you moving on having a skilled lender. They could set you up into greatest home loan and you can reduced pricing which means you along with your kids can also be spend high quality day to one another.

First House

We classify a first family because family you reside for many the year. Usually, mortgage rates of interest could be the lower of one’s step three residence categories.

The prerequisites for qualifying having a primary residence mortgage is including less than other types of homes. As an example, you can aquire a first home with a down-payment because the lower just like the 3%, as well as your personal debt to money ratio is high.

Loan providers provide such advantages while they trust they take on faster risk when credit for a first home. In financial problem circumstances, consumers are more motivated to purchase the brand new rooftop not as much as and this it real time than other sorts of homes.

Second Quarters

A holiday home is a home you live in for less than simply a majority of the year. You may have nearest and dearest and colleagues that actually work towards different coasts otherwise that are snowfall bunnies you to definitely real time up northern however, spend its summer seasons within the warmer weather. Really trips residential property fall under brand new supplementary home group.

Whenever money a second family, qualifications range from a first household. An important marker is you you should never play with FHA or Va Domestic Financing to pay for such properties. Concurrently, credit score and you may loans so you can money proportion standards usually are more strict.

So it assures the lending company is actually taking up a secure amount of risk to end defaulting toward home mortgage. You may need a top deposit having vacation property purchased one was second houses.

Investment property

If you buy a home on intention of leasing it away for rental money, we would think about it a residential property. These may either be long-title rentals otherwise vacation rentals, particularly Airbnb’s or VRBO’s.

Financial support characteristics vary from number 1 and you can second land that have possessions taxation and you can deductions. It’s adviseable to know that fund requirements can differ which have travel belongings Bridgewater pay day loan alternatives in this category.

Such as, capital land want higher off repayments but down credit ratings. The lending company may require one to possess money on hands in order to safety half a year off home loan repayments just before might provide to help you you too.

End Vacation House Ripoff

We believe you need to know you to definitely classifying accommodations family since a secondary house is scam and can cause severe judge outcomes. This means your perfect vacation home if you call-it an investment property whenever extremely its a summer time escape.

not, you may be able to identify your trip possessions just like the an excellent secondary household if you reside inside over two weeks a year or ten% of one’s months it’s rented. A talented real estate professional should be able to describe questions for your requirements inside domain.

Now you learn if for example the vacation house categorizes as a good supplementary family or accommodations property, you must determine how might finance the purchase.

Finance companies much more liberal making use of their financing techniques to possess no. 1 homes, but that doesn’t mean youre ineligible to have reasonable mortgages.

Of numerous choose gain an advance payment having a secondary home that have a funds-away re-finance of its first financial otherwise protecting a house collateral personal line of credit. This is very effective once the a high down payment stops higher rates of interest and you can promises lower monthly installments.

Could you Meet up with the Loan Standards?

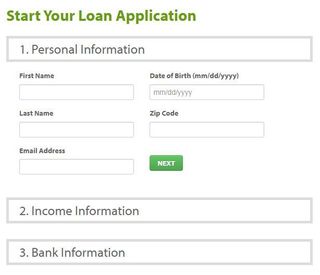

Vacation mortgage brokers range from bank so you can financial, if they is actually a talented private bank or a financial. We recommend calling numerous parties to see whom brings personalized solution and you may finance the thing you need to own a holiday possessions.

- Obligations to help you earnings proportion up to 43-forty-five %.

- Credit history more than 640

- Minimum 10% down-payment

- Set-aside regarding dos-six months mortgage payments

For individuals who satisfy such qualifications, you are prepared to start vacationing in the correct manner! You should never waste any longer of your energy and energy selecting ways high-priced accommodations. Alternatively, clean up your own suitcase and venture out on individual trips possessions.

We focus on finding the right home loan selection for you. Don’t worry about learning the fresh new particulars of vacation mortgage loans yourself. You will find complete that actually work to you personally and can determine the of your home loan choice step-by-action.

Contact us today during the (480). to inquire of all of your issues. Begin your fascinating excursion for the purchasing your dream travel domestic today!