- What exactly is a home guarantee mortgage?

- How does it works?

- Benefits and drawbacks

- Who qualifies?

- House guarantee loan vs. home guarantee line of credit (HELOC)

- Achievement

Representative website links on things in this article are from partners one make up you (find our very own advertiser disclosure with the help of our listing of partners for lots more details). Although not, all of our feedback is our very own. Find out how we speed mortgage loans to type objective ratings.

- A home guarantee mortgage is actually a moment financial that uses your own house because the collateral.

- Most lenders can help you obtain up to a mixed ratio off 80% so you’re able to 90% of house’s worthy of.

- You might treat your house if you can’t build your monthly payments.

If you’re considering making improvements to your house, need help purchasing the child’s school, otherwise against other biggest bills, playing with a house equity financing could be an easy way to rating your hands on a big amount of cash.

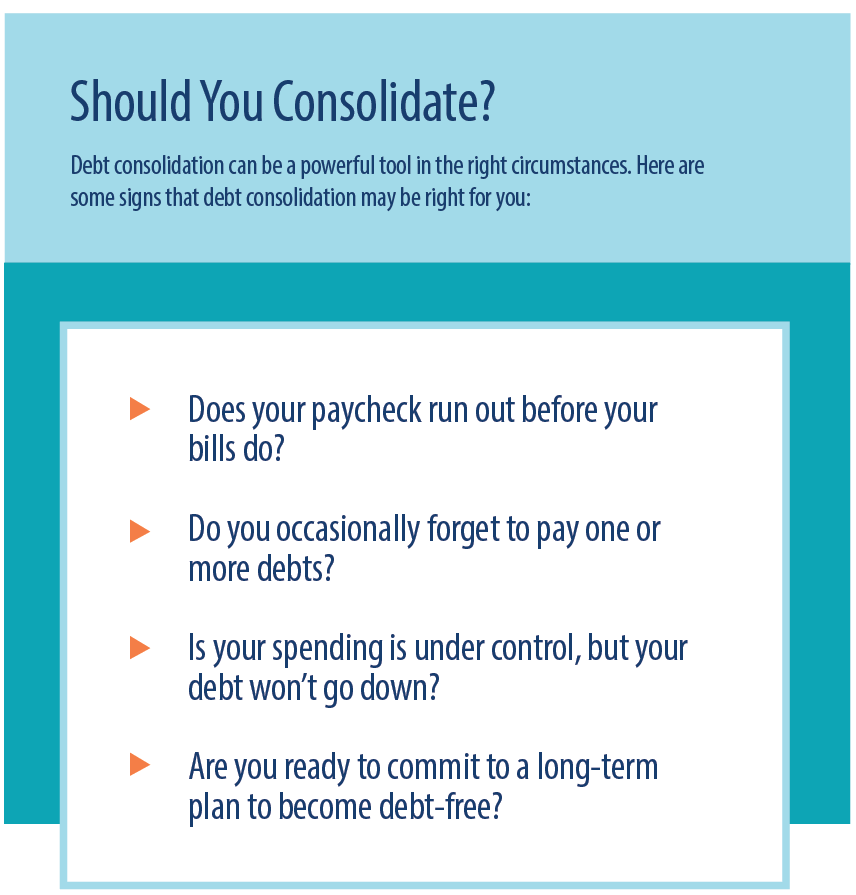

For many homeowners, a house collateral mortgage you can expect to give them entry to more money than any different kind off financing. Plus, this type of fund usually incorporate greatest rates of interest and you may terms and conditions than simply other designs from loans, such as handmade cards and private fund.

But family collateral funds incorporate its fair share away from dangers, too. Some tips about what you need to know about house guarantee money before you begin contacting lenders and you will filling in mortgage documents.

Definition

A property guarantee financing is a kind of next home loan one uses your residence since collateral and you will makes you acquire of their collateral.

Eg, if the residence is value $250,000 while are obligated to pay $100,000 on your home loan, you already have $150,000 off “equity” of your house. A house collateral financing lets you borrow a portion of you to definitely matter.

With family equity funds, you could potentially typically borrow up to 80 to help you 90% of one’s house’s well worth – without https://paydayloansconnecticut.com/lakes-west/ any harmony on the main mortgage loan. You get which cash in cash, because a lump sum payment shortly after closure, and then make equivalent monthly premiums through to the loan is repaid back. You normally have four to help you 30 years to accomplish this.

Understand that home guarantee financing use your household given that collateral, just as in most other mortgages. It means you can dump your property if you don’t build money.

Next home loan

Household security financing is actually a variety of second home loan, definition they truly are a mortgage which is also most of your that. They show up which have another payment per month.

HELOCs – otherwise house guarantee credit lines, was a unique next mortgage, in the event it works in a different way. (On this afterwards).

How come property guarantee loan works?

Taking out a house collateral financing is a lot like taking out a typical mortgage, with many key variations. Here’s how to find a property collateral financing:

Borrowing processes

To acquire a property equity mortgage, you will have to use having a lender and you will complete financial records, such as tax returns, W-2s, financial statements, plus.

The lending company will order an assessment to find the home’s value and how much security you must use regarding.

From that point, their bank will underwrite the loan, and you may agenda your a closing time. That is where you’ll shell out your own settlement costs, sign the last paperwork, and also have the funds.

Installment terms

Family security financing have various term choice. You might generally prefer between five- and you will 30-year cost terms.

Very family guarantee funds has fixed rates of interest. It indicates your own rate – plus monthly payment – will stay a comparable the entire day you’ve got the loan.