The process of bringing preapproved for choosing a home are a tiny nerve wracking, particularly when you will be an initial-day homebuyer.

The first thing are searching for a lending company otherwise broker. Excite comprehend my blog post, Why Get Pre-Approved getting a mortgage and exactly how Perform I understand Just who Is the Proper Lender Personally?

To order a home is often a tiny nerve wracking. My party and that i was here to hold your own hands and make it easier to every single action of way! We all have been using most of the the fresh technical available but along with like functioning the existing-designed method of the meeting deal with-to-face. We are going to work with you for the any kind of styles best suits your needs and you may wishes.

After you have selected a lender, you may be willing to fill in an effective pre-acceptance app. My personal prominent loan providers have the software techniques online, otherwise, you might satisfy her or him them really if you need or even perform the app over the phone. Either way, you are going to offer details about the sort of financing your seek, your income, etc.

Just what Software Need in the process of Delivering Preapproved

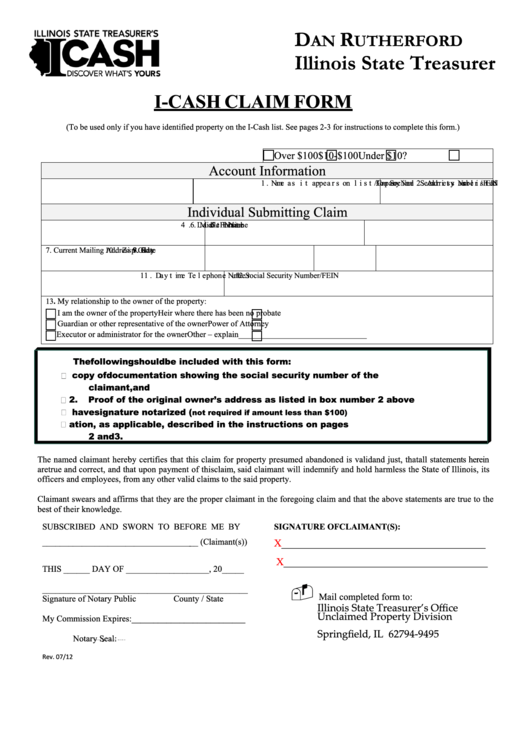

It software demands that reveal your name, address for a few years, birth big date, personal coverage amount and you may functions record the past 2 yrs, including information about your finances. Pre-approvals wanted a credit file for all consumers.

The mortgage manager spends all the info provided towards financial app discover a credit file along with about three credit bureaus. That it declaration are assessed from the lender’s underwriter so that the borrowing from the bank direction try satisfied.

Your credit history boasts the credit score certainly most other essential pieces of data. Credit history standards confidence the borrowed funds system removed. The financial institution in addition to investigates the fee records and inspections to see if you will find people biggest credit things. Present bankruptcy, foreclosure or unpaid taxation liens is reasons to refuse a loan.

Quite often, my well-known bank can manage any guidance owing to an automatic underwriting process and acquire a first pre-approval, but then we still wade then.

The lending company will then leave you a whole listing of the latest records (We refer to it as the dishes checklist) they need shortly after you fill out an application. Specific data are essential from the individuals, in this way number lower than but extra records may be needed depending on your own personal disease. The basic, initially records you will have to promote is actually:

Pay Stubs To possess Money Verification If you’re working, the financial institution will need recent pay stubs and frequently W-2’s for the most current a couple age. The lenders determine your legs money and view if any overtime, incentive or commissions can be used to be eligible for the borrowed funds. Loan providers also can want a two-season reputation for acquiring profits, overtime otherwise bonuses before one to money are often used to pre-be eligible for the borrowed funds.

Taxation statements Plan on providing the last two years of your taxation statements. A number of low-a job earnings, such as for instance notice and you will dividends, old age income and you will public shelter money, need tax statements too. For many who individual a company you to data files corporate tax returns, you might have to bring people business returns, in addition to any K-1’s, earnings data files including an excellent W-dos or 1099 that will be approved for your requirements in case your business is actually a partnership or S-Corporation).

Employment Verification This could be a summary of your own companies getting the brand new pat 2 yrs and brands, address contact information and you may phone numbers.

Bank Comments You are needed to bring documents out of in which the fresh new downpayment and you will closing costs are arriving out-of. The most common resource files is financial statements or investment statements. Of a lot loan providers don’t let cash on hands (currency leftover outside of a financial institution) for usage getting an advance payment or settlement costs. When the a relative, business otherwise non-earnings is giving you a gift or give towards down fee, you are required to bring something special page and you will facts that the donor comes with the money provide. Always a couple of months’ financial comments are needed.

More Documents Based on exactly what your files shows, you may have to bring more info. Teachers are requested to include the a position package, since they are paid over nine, ten otherwise one year, and also make figuring the amount of money regarding a cover stub alone difficult. While doing so, lenders can get ask you to establish high low-payroll deposits, small bad activities on your own credit history otherwise a name difference. This might be well-known for ladies just who changes its labels after they age that have a daddy.

Self employment Documents. In the event the applicable. People who are self employed may need to render a lot more or solution files including cash-and-loss statements, Government tax statements and you may/otherwise harmony sheets over installment loans online Delaware the past a couple of years.

Disclosures The loan administrator and you may home loan company who underwrite your loan, when they independent entities, are one another needed to provide you with papers once you use to own good pre-approval. Both loan officer and you can bank gives you a great Good-Faith-Guess, or GFE.

That it document teaches you the costs and you may regards to the loan your enjoys applied and you can been recognized to possess. You will be provided a duplicate of one’s software and you can of many disclosures, in addition to alerts of one’s straight to a copy of one’s appraisal, maintenance revelation declaration (shows exactly how many loans the business enjoys or deal) and also the Connected Team Plan (explains exactly what third-party businesses are so long as you characteristics). The borrowed funds manager possess around three working days from your own software in order to present a beneficial GFE, plus the lender keeps around three business days from the time it get the applying to give you a beneficial GFE too. Really change on the loan amount, rate or conditions requires yet another GFE be offered.

Achievement and you may Summation undergoing providing preapproved We have tossed a number of information within you with this blog post. So why don’t we synopsis a number of the tips. Home loan pre-approval are a method the spot where the bank ratings your financial history (credit rating, money, expenses, etc.). They do this to determine even though you happen to be certified for a financial loan. They’re going to also inform you simply how much he could be prepared to lend your.

So, you will find a touch of try to would initial and also make yes you should buy a house, but when its over, we are able to focus on trying to find you your dream family. Go ahead and call me when to own a zero obligation consultation.