Selecting the right home loan company is very important. Not only will it impact what finance you qualify for, but inaddition it affects your own rate of interest, costs, deposit and a lot of time-term will cost you, also.

Picking a home loan company isn’t really usually cut-and-dry, though. To start, you should believe about 3 to 5 more organizations. This will leave you numerous possibilities and, centered on an effective Freddie Mac computer research, actually help save you doing $3,000.

One of the primary points that can apply at costs is actually desire prices, and when it comes it comes to lenders, there isn’t a-one dimensions suits all the respond to. Very, be sure to examine pricing and you can crunch the fresh number to keep more cash.

Interest levels

Interest levels differ by mortgage company. Each of them has its own over will cost you, mortgage frequency, staffing capabilities, profit wants and more. Predicated on Freddie Mac computer, a debtor are able to see the rates are different doing 0.22% around the five lenders.

And if you’re prepared to remove home financing, dont waiting start-off of the evaluating rates of interest now.

Discover an idea of just what speed a loan provider can offer your, apply for pre-recognition . This involves submitting some elementary financial information and details about the household get. They upcoming make you that loan guess, and this breaks down the estimated charge and costs.

Charge

Mortgage loans come with a lot of costs, and these charge really effect your own closing costs – or just how much you need to give the brand new closure dining table.

Same as interest rates, this type of charge differ substantially ranging from lenders. Specific costs origination costs or software fees, and several cannot. There are numerous most other charges which come to your mix, as well, therefore definitely evaluate the loan estimates line by-line.

You’ll be able to search towards page step one within “Estimated Closing costs” and “Estimated Bucks to close” traces to own a quick testing of complete fees and you will costs.

Mortgage products

All mortgage system features some other being qualified requirements and you can advance payment minimums, it is therefore crucial that you weighing a great lender’s mortgage products, also. An enthusiastic FHA loan, like, demands simply step 3.5% off and you can makes it possible for lower credit ratings, nonetheless can simply become granted because of certain loan providers.

USDA loans, which happen to be backed by the fresh U.S. Company away from Agriculture, need no down payment however,, once more, are merely readily available compliment of recognized home loan businesses.

Investigation up on just what home loan apps work for your budget and you can credit character, and rehearse you to to compliment your own financial research. This informative guide so you can off payments is a fantastic starting place.

Reputation and you can services

A good lender’s reputation and you will services is always to play a role too. You can look so you’re able to online feedback and you may critiques discover a keen idea of what kind of provider a company also offers otherwise, even better, pose a question to your agent. They might features met with the bank ahead of and now have basic-hand facts.

The new Nationwide Mortgage Certification Method is another great money to explore. Merely research the business you’re thinking about playing with, and you can examine all of the the permits, choice business labels and you may people regulating methods from the company which have a few clicks.

Techniques and you can presence

It’s adviseable to be the cause of an excellent lender’s process. Earliest, precisely what does pre-recognition appear to be? Do you really take action quickly and easily on the web? The length of time does it try listen to straight back? Definitely understand what records they want (and test for warning flags towards the app ) so you’re able to get it attained and on hand.

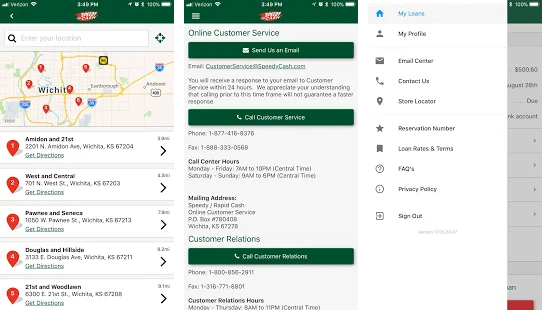

Second, check its on the internet visibility. Perform they offer plenty of instructional resources? Perform he has an app? Is there customer support via mobile phone, chat, email as well as in-person fulfilling? We need to Coffeeville loans favor a lender who will fulfill the criterion – both in the app procedure and you will long-term.

How exactly to raise your odds of providing acknowledged to own a home loan

Evaluating loan providers is just one part of the loan procedure. To make certain your home pick goes effortlessly, manage boosting your credit history and gather debt documents very early. You’ll normally you want their past one or two W-2s, tax statements, shell out stubs and you may bank account comments, at least.

It’s adviseable to stay away from any large-pass sales as you grow closer to a home pick and you can prevent taking out fully one the fresh new handmade cards or funds. These could hurt your odds of getting home financing.

Have significantly more home loan inquiries? Uncertain what type of rates you’d qualify for? Keep in touch with a professional nowadays who can help.